- #QUICKEN FOR MAC UK FULL#

- #QUICKEN FOR MAC UK SOFTWARE#

- #QUICKEN FOR MAC UK DOWNLOAD#

- #QUICKEN FOR MAC UK FREE#

Make sure to set the Account Name and the Account Type to create a QIF file for the right account. IMPORTANT: QBO2QIF is now replaced with the Transactions app, which converts from more formats and converts to more formats.

#QUICKEN FOR MAC UK DOWNLOAD#

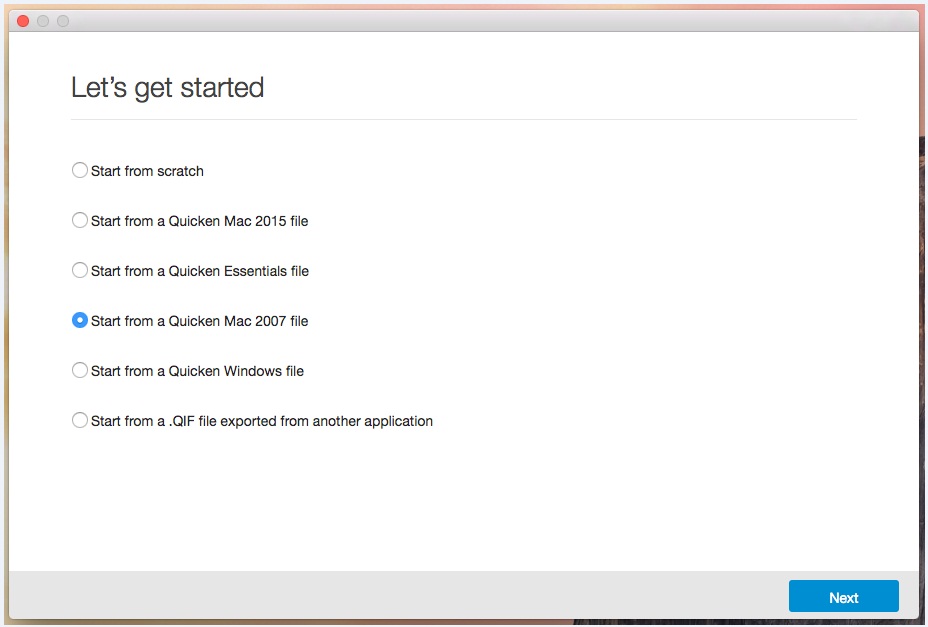

Download it from the QBO2QIF download page. Make sure you are using the latest version of QBO2QIF. For Quicken 2018 or later, you have to select the actual account. To import a QIF file, select 'File' - 'File Import' - 'QIF File', select created QIF file.įor Quicken 2017 or earlier, it is important to select ''All Accounts''. Before importing a QIF file make sure to backup your data.

Now the QIF file is created, let's switch to Quicken and import created QIF file. Import created QIF file into Quicken 2019 Set 'Output dates' if applicable.Ĭlick the 'Convert' button to create a QIF file. Set the Account Name (must be matched as you have in Quicken) and the Account Type (must be matched as you have in Quicken) to create a QIF file for the right account. Select the QIF Target to match your Quicken version or your accounting software: Quicken 2018+, Quicken 2017, Quicken 2015-2016, Quicken 2014 or earlier, Banktivity, Microsoft Money, NetSuite, MYOB, Reckon, YNAB, Quicken UK, AccountEdge, old Microsoft Money non-US, Quicken 4, Quicken French 2015. Review transactions before converting, check that dates are correct, have the correct year, deposits, and withdrawals are assigned correctly.

#QUICKEN FOR MAC UK FREE#

Sign up for a free newsletter from Which? Money for the latest in money news and expert tips to help you keep your finances on track.Follow the steps below for the Windows version, followed by the Mac version. The programmes we tested allow you manually input information, which is generally a safer option than giving a firm access to your accounts.įind out more: Open banking: sharing your financial data explained Get the latest news and money-saving tips

#QUICKEN FOR MAC UK SOFTWARE#

None of the personal finance software packages we tested is set up for the Open Banking scheme, which allows you to share current account data through a secure connection via application programming interfaces (APIs). While these programs usually offer their own security guarantees, you may not have recourse to your bank’s fraud protection if any money goes missing or your details are used improperly. The software may ask for your login details to collect or ‘screen scrape’ your transaction data – essentially posing as you to access your accounts. If you do find a way to link your UK bank account to your package, you may be taking a risk. In practice, however, very few banks outside the United States are able to connect directly to these packages.

Some personal finance software packages may state in marketing materials that they can import data from your bank accounts. Sharing data with personal finance software You can use these tools for a more sophisticated analysis of your financial position, instead of managing your budget manually, with lots of spreadsheets on the go. The software allows you to set reminders for upcoming payments, analyse incomings and outgoings with charts or graphs, and set short- and long-term budgets. This can be a powerful tool if, for example, you want to see how long it will take to save up for a car, or where you could cut back on spending. Personal finance software allows you to see where your money is going on a monthly or yearly basis, and use this information to set goals.

#QUICKEN FOR MAC UK FULL#

If you're not already a member, join Which? and get full access to these results and all our reviews. Which? members can log in to see the full results in the table below. Our table below shows how these complex tools were rated on features that are important to you, including overall performance, customer support and the mobile app. In our latest tests, we awarded three Best Buys, while one of the packages was very close to being awarded a Don’t Buy. We tested nine of the leading personal finance software packages available to UK users - You Need A Budget, Moneydance, AceMoney, Buxfer, Banktivity, BankTree, Home Accountz, GnuCash and HomeBank. While some packages are free to use, some will charge you anywhere up to £60 a year. Which? members can log in to see the full results in the table below. If you're not already a member, join Which? and get full access to these results and all our reviews. We put nine personal finance software packages to the test, to find out which are best at helping you manage your money. The programmes allow you to monitor your bank accounts, credit cards, loans and investment balances in one place, as well as log your income and outgoings – giving you an in-depth picture of your position and helping you set goals for the future. Personal finance software helps you keep track of your money and make smarter financial choices.

0 kommentar(er)

0 kommentar(er)